Bangor TV Guide: Comprehensive Overview (Updated 02/03/2026)

Bangor’s television landscape, as of today’s date, thrives with diverse content, from Megadeth concert footage to discussions on Fallout and Dune series.

Local Bangor Channels & Networks

Bangor, Maine, benefits from a mix of locally-focused and nationally-distributed television channels. While specific channel lineups are subject to change with provider packages, residents generally have access to major networks like CBS, NBC, ABC, and FOX through affiliated stations. Local news coverage is a cornerstone, providing vital information about community events, weather updates, and regional happenings.

Beyond the mainstream, several smaller, independent channels cater to niche interests. These may include public access channels showcasing local programming, religious broadcasts, or channels dedicated to specific hobbies. The vibrant local music scene, exemplified by events like the Megadeth concert, often receives coverage on these networks, fostering a sense of community. Furthermore, Bangor viewers actively engage in discussions about popular shows like Fallout and Dune, demonstrating a strong connection to televised entertainment.

Digital Television Transition in Bangor

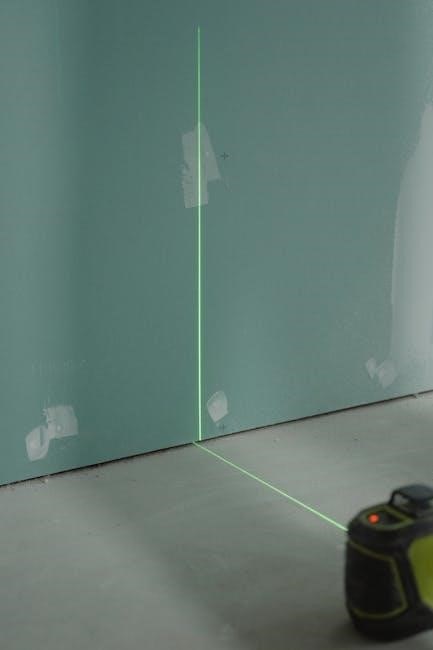

Bangor successfully completed the digital television (DTV) transition several years ago, ensuring residents receive clearer picture and sound quality. This shift involved phasing out analog broadcasts and adopting digital signals, requiring viewers to either upgrade their televisions with digital tuners or utilize converter boxes. The transition aimed to free up valuable spectrum space for public safety communications and other services.

Today, most Bangor households access television through digital cable, satellite, or over-the-air antennas capable of receiving digital signals. The availability of high-definition (HD) and ultra-high-definition (UHD) programming has significantly enhanced the viewing experience. Ongoing advancements in compression technologies continue to improve signal efficiency and allow for the delivery of more channels and content. This digital infrastructure supports the diverse entertainment options enjoyed by Bangor viewers, including discussions about shows like Fallout and Dune.

Streaming Services Available in Bangor

Bangor residents have access to a wide array of streaming services, complementing traditional television viewing. Popular platforms like Netflix, Hulu, Amazon Prime Video, and Disney+ offer extensive libraries of movies, TV shows, and original content. These services provide on-demand entertainment, allowing viewers to watch what they want, when they want, without being tied to fixed broadcast schedules.

Furthermore, specialized streaming services cater to niche interests, including music (Spotify, Apple Music) and live TV (YouTube TV, Sling TV). The increasing availability of high-speed internet in Bangor facilitates seamless streaming experiences. Many viewers now supplement their cable or satellite subscriptions with streaming services, or even cut the cord entirely, relying solely on internet-delivered content. Discussions surrounding series like Fallout and Dune often occur online, fueled by streaming accessibility.

Bangor TV Listings: Finding What to Watch

Bangor viewers utilize online guides and mobile apps to discover programming, including local news, music coverage, and popular series like Dune.

Online TV Guide Resources for Bangor

Bangor residents have access to a wealth of online resources for discovering television listings. These platforms provide comprehensive schedules, allowing viewers to easily navigate the diverse programming available through local channels, cable, and satellite providers. Many websites offer advanced search functionalities, enabling users to pinpoint specific shows, genres, or actors.

Furthermore, several online TV guides incorporate user reviews and ratings, offering valuable insights into program quality. These resources often include episode guides, cast information, and behind-the-scenes content, enhancing the overall viewing experience. The ability to create personalized watchlists and set reminders ensures that viewers never miss their favorite shows, whether it’s a local news broadcast, a captivating drama series like Fallout, or a thrilling concert performance like Megadeth in Bangor.

Dedicated websites also catalog official sites for various industries, providing a broader online experience beyond just television programming.

Using TV Guide Apps on Mobile Devices

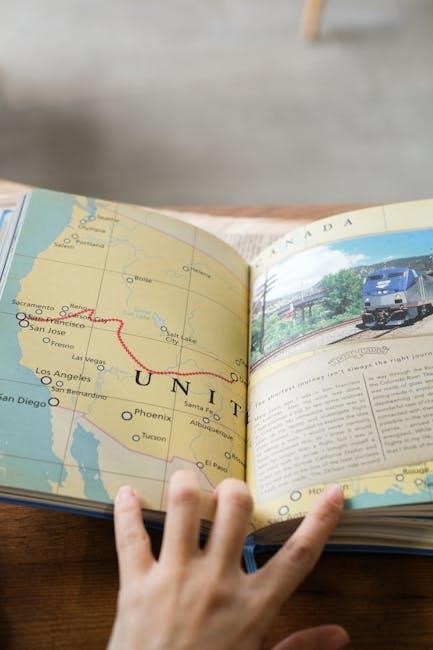

Bangor viewers increasingly rely on mobile TV guide applications for convenient access to programming schedules. These apps offer a user-friendly interface, allowing users to browse listings on smartphones and tablets. Real-time updates ensure accuracy, reflecting any last-minute changes to the broadcast schedule. Many apps provide personalized recommendations based on viewing history, helping users discover new shows and movies.

Beyond basic listings, these applications often include features like show reminders, direct links to streaming services, and the ability to share viewing plans with friends. The portability of mobile devices allows Bangor residents to stay informed about television programming while on the go, whether commuting, traveling, or simply relaxing at home. Discussions about series like Dune or events like the Megadeth concert are easily planned.

These apps enhance the overall television experience, offering a seamless blend of convenience and entertainment.

Bangor Cable & Satellite Providers

Bangor residents have several options for accessing television programming through cable and satellite providers. These companies deliver a wide range of channels, including local networks, national broadcasts, and specialized content. Service packages typically vary in price and channel selection, catering to diverse viewing preferences.

Competition among providers drives innovation, with many offering bundled services that combine television with internet and phone access. Installation and customer support are key considerations when choosing a provider, ensuring a smooth and reliable viewing experience. As digital television transitions continue, providers are adapting their offerings to meet evolving consumer demands.

Understanding available options is crucial for Bangor households seeking the best value and programming choices, especially when planning to watch events like a Megadeth concert or follow a series like Fallout.

Popular Shows & Events Broadcast in Bangor

Bangor viewers actively discuss Fallout and Dune, alongside enjoying local music coverage and high-quality video footage of Megadeth concerts.

Megadeth Concert Footage & Local Music Coverage

Bangor’s local television stations consistently provide coverage of significant musical events, with a notable example being the high-quality video footage of Megadeth’s concert in Bangor, Maine, from March 24, 2016. This footage remains a popular request among local metal fans.

Beyond nationally recognized acts, local channels dedicate airtime to showcasing the vibrant Bangor music scene. This includes performances from local bands – like those performing songs such as “They Didn’t Wanna Show Me Any Love At All” (October 2, 2015) – and coverage of music festivals and events held throughout the year.

The commitment to local music extends to interviews with artists, behind-the-scenes glimpses into the creation of music, and promotion of upcoming shows. This dedication fosters a strong connection between the television audience and the thriving artistic community within Bangor.

Fallout & Dune TV Series Discussions (Bangor Viewers)

Recent television programming has sparked considerable discussion amongst Bangor viewers, particularly regarding the Fallout TV series and the Dune films. Local conversations, as evidenced by discussions between Adam Laughlin, Sarah Taylor, and others, delve into intricate details of these productions.

These discussions aren’t limited to plot summaries; they extend to more nuanced topics, such as the anatomical considerations of fictional creatures – specifically, the “sand worm peniss” referenced in local commentary – and the exploration of related themes within popular culture.

Bangor residents actively engage with these shows, sharing opinions and theories online and in person, demonstrating a strong community interest in science fiction and fantasy entertainment. This engagement highlights television’s role in fostering shared experiences and intellectual debate within the city.

Local News & Weather Broadcasts

Bangor’s television landscape heavily features local news and weather broadcasts, serving as a crucial source of information for residents. These programs provide up-to-date coverage of community events, local government proceedings, and emergency situations, ensuring citizens remain informed about matters directly impacting their lives.

Weather reports are particularly vital, given Maine’s often unpredictable climate. Viewers rely on these broadcasts for accurate forecasts, helping them prepare for everything from snowstorms to heat waves. The importance of television in daily life is underscored by anecdotes, like the “panic” experienced when a TV signal was lost in one Bangor household.

Local stations prioritize delivering timely and relevant information, solidifying television’s position as a cornerstone of the Bangor community.

TV’s Role in Bangor Community Life

Television profoundly impacts Bangor households, exceeding expectations; it’s a central hub for news, entertainment, and even a source of unexpected panic, reportedly!

Impact of Television on Bangor Households

Television’s presence within Bangor homes extends far beyond simple entertainment, becoming deeply interwoven into the fabric of daily life. As evidenced by one anecdotal account, the sudden absence of television can even induce a sense of panic within a household, highlighting its significant role as a constant companion and source of information.

Beyond immediate reactions, television serves as a communal focal point, fostering shared experiences through programs like concert footage – specifically, the high-quality video of Megadeth’s performance in Bangor – and sparking conversations around popular series such as Fallout and Dune. These shared viewing experiences contribute to a sense of community and provide common ground for discussion amongst residents.

Furthermore, local news and weather broadcasts delivered via television are crucial for keeping Bangor households informed about events impacting their immediate surroundings, solidifying television’s position as an essential utility within the home.

Cultural & Horror Content Consumption in Bangor

Bangor demonstrates a notable appetite for diverse content, extending beyond mainstream entertainment to encompass both cultural explorations and the horror genre. Online platforms and traditional television broadcasts cater to these interests, fostering a community of viewers engaged in discussing and dissecting various forms of media.

The readily available access to shows like Fallout and Dune sparks lively debates, as evidenced by discussions involving topics ranging from intricate plot details to, surprisingly, anatomical considerations within the fictional universes. This engagement suggests a sophisticated viewership capable of critical analysis and enthusiastic participation.

Moreover, the referenced posts regarding “Культура и Ужасы” (Culture and Horror) indicate a dedicated online space where residents share personal experiences, insightful articles, and engaging multimedia related to these genres, further solidifying Bangor’s vibrant media consumption landscape.

Enhancing Your TV Viewing Experience

Bangor viewers can leverage English-language TV for language learning, expanding vocabulary and improving grammar skills through immersive content exposure.

Language Learning Resources via English-Language TV

Bangor residents seeking to enhance their English language proficiency can significantly benefit from utilizing readily available television programming. Immersive exposure to authentic language, as presented in various shows and broadcasts, provides a dynamic learning environment. Consider utilizing subtitles initially, gradually reducing reliance as comprehension improves.

Focus on diverse genres – news broadcasts offer formal language, while dramas and comedies showcase colloquial expressions. The provided methodological guidance, containing artistic and journalistic texts in English, complements this approach.

Furthermore, actively engage with the content by pausing to look up unfamiliar words or phrases. Relate the observed language to real-life scenarios, solidifying understanding and retention. Remember, consistent exposure and active engagement are key to successful language acquisition through television.

Improving Vocabulary & Grammar with TV Shows

Bangor viewers can leverage English-language television to actively expand their vocabulary and refine their grammatical understanding. Pay close attention to sentence structures and how native speakers employ different tenses and phrasing. Keep a dedicated notebook to record new words encountered, alongside their definitions and contextual usage.

The 204-page resource mentioned highlights exercises specifically designed for vocabulary and grammar enhancement, aligning perfectly with this approach.

Don’t simply memorize words; strive to use them in your own sentences, reinforcing learning. Analyze how characters interact and the nuances of their dialogue. Consistent practice, combined with focused observation of television content, will demonstrably improve linguistic skills and fluency for Bangor residents.

Technical Aspects: Dictionary & Anagram Algorithms (Related to Show Titles)

A fascinating technical application related to Bangor’s TV viewing habits involves utilizing dictionary resources and anagram algorithms. Consider show titles – for example, analyzing the letters within “Fallout” or “Dune” to generate anagrams. This exercise, while playful, demonstrates computational linguistics principles.

The referenced algorithm searches dictionaries and generates anagrams for given phrases, offering a unique way to interact with show titles.

Developing such algorithms requires understanding data structures and search techniques. This can be a stimulating intellectual pursuit for Bangor residents interested in the intersection of television, language, and computer science, potentially inspiring further exploration of linguistic patterns within broadcast content.

Bangor University & TV Studies

Bangor University researchers actively study television, including phonetic parameters of English broadcasts, contributing to academic understanding of media consumption.

Academic Research on Television (University of Wales, Bangor)

The University of Wales, Bangor, has a demonstrated history of scholarly engagement with television studies, evidenced by publications dating back to 2019. Research extends beyond mere content analysis, delving into the intricate phonetic parameters of English language broadcasts – a crucial aspect often overlooked.

This includes investigations into how vocal delivery, pacing, and accent influence audience perception within the Bangor community and beyond. Furthermore, academic work considers the broader cultural impact of television, acknowledging its significant role in Bangor households, as highlighted by anecdotal observations regarding disruption when broadcasts cease.

Studies also explore the consumption of specific genres, like horror and cultural content, and the potential for television to serve as a language learning tool, enhancing vocabulary and grammar skills through immersive viewing experiences. The university’s research actively contributes to a deeper understanding of television’s multifaceted influence.

Phonetic Parameters of English Language Broadcasts

Detailed analysis of English language broadcasts within the Bangor region focuses on nuanced phonetic elements. Research, as conducted by Sokoreva and Shevchenko (2022), meticulously examines variations in pronunciation, intonation, and speech rate across diverse programming. This extends to identifying regional accents and their impact on comprehension for viewers in Bangor, Maine, and Wales.

Investigations consider how sound mixing and audio engineering contribute to the overall auditory experience, potentially influencing emotional responses and message reception. The study of these parameters isn’t merely academic; it has practical implications for improving accessibility and clarity for all viewers.

Understanding these elements is crucial for optimizing broadcast quality and ensuring effective communication, particularly within a community like Bangor, where diverse linguistic backgrounds may exist. This research provides valuable insights into the subtle yet powerful ways television shapes our perception of language.

Future Trends in Bangor TV

Bangor’s TV future anticipates evolving viewing habits, potential new channels, and content catering to diverse interests, mirroring broader industry shifts and local tastes.

The Evolution of TV Viewing Habits

Bangor’s television consumption is undergoing a significant transformation, mirroring national trends but with unique local characteristics. Traditionally, households relied on cable and satellite providers for scheduled programming, a pattern disrupted by the rise of streaming services. This shift empowers viewers with on-demand access to a vast library of content, altering peak viewing times and program preferences.

The impact of television on Bangor households, as noted, extends beyond mere entertainment; it’s deeply interwoven into daily life. However, the panic experienced when a TV malfunctions highlights a growing dependence. Furthermore, discussions surrounding shows like Fallout and Dune demonstrate a communal aspect to viewing, fostered by online platforms and local conversations.

Looking ahead, we anticipate a continued fragmentation of viewership, with personalized recommendations and niche content gaining prominence. The availability of language learning resources via English-language TV will also likely influence viewing choices, alongside a growing interest in cultural and horror content.

Potential for New Channels & Content

Bangor’s media landscape presents opportunities for specialized channels catering to local interests. Increased coverage of local music, building upon existing Megadeth concert footage and similar events, could resonate strongly with residents. A dedicated channel showcasing University of Wales, Bangor research – particularly in TV studies and phonetic parameters of English broadcasts – would appeal to an academic audience.

Furthermore, content focusing on the cultural and horror preferences within the community, as evidenced by online discussions, could attract a dedicated viewership. Exploring the impact of television on Bangor households through documentary-style programming offers another avenue.

The integration of interactive elements, leveraging dictionary and anagram algorithms related to show titles, could enhance viewer engagement. Ultimately, successful new channels will prioritize hyper-local content and cater to the evolving viewing habits of Bangor residents.